Management of Trading Sessions.

Generating the Detailed Reports On System Operation.

Online Risk Control and Management of Client Orders.

Granting Access Rights and Configuring the Hierarchical Structure of Users.

Administration of Trade Positions and Orders.

User Account Management.

Management of Liquidity Providers and Price Flows.

Effective Management of Commissions, Markups, and Swaps

The value for each of the above components can be set individually. The advanced functionality also allows you to customize BID and ASK quotes separately for higher returns. A broker can import swap parameters directly from a text or Excel file.

Managing of Trading Sessions

The back-office functionality allows you to make detailed settings for the process of managing trading sessions. You can customize the trading schedule based on the needs of traders, the opening hours of liquidity providers, or your company’s internal operations.

Generating the Detailed Reports On System Operation

You can create customized reports and filter them within the platform according to the selected parameters. This will allow you to analyze the performance level of your brokerage company instantly.

The use of various reporting tools also helps monitor the trading activity of each account and a particular user for a chosen period. You can import all reports into XLS, SCV, PDF, HTML, or TEXT files in one click.

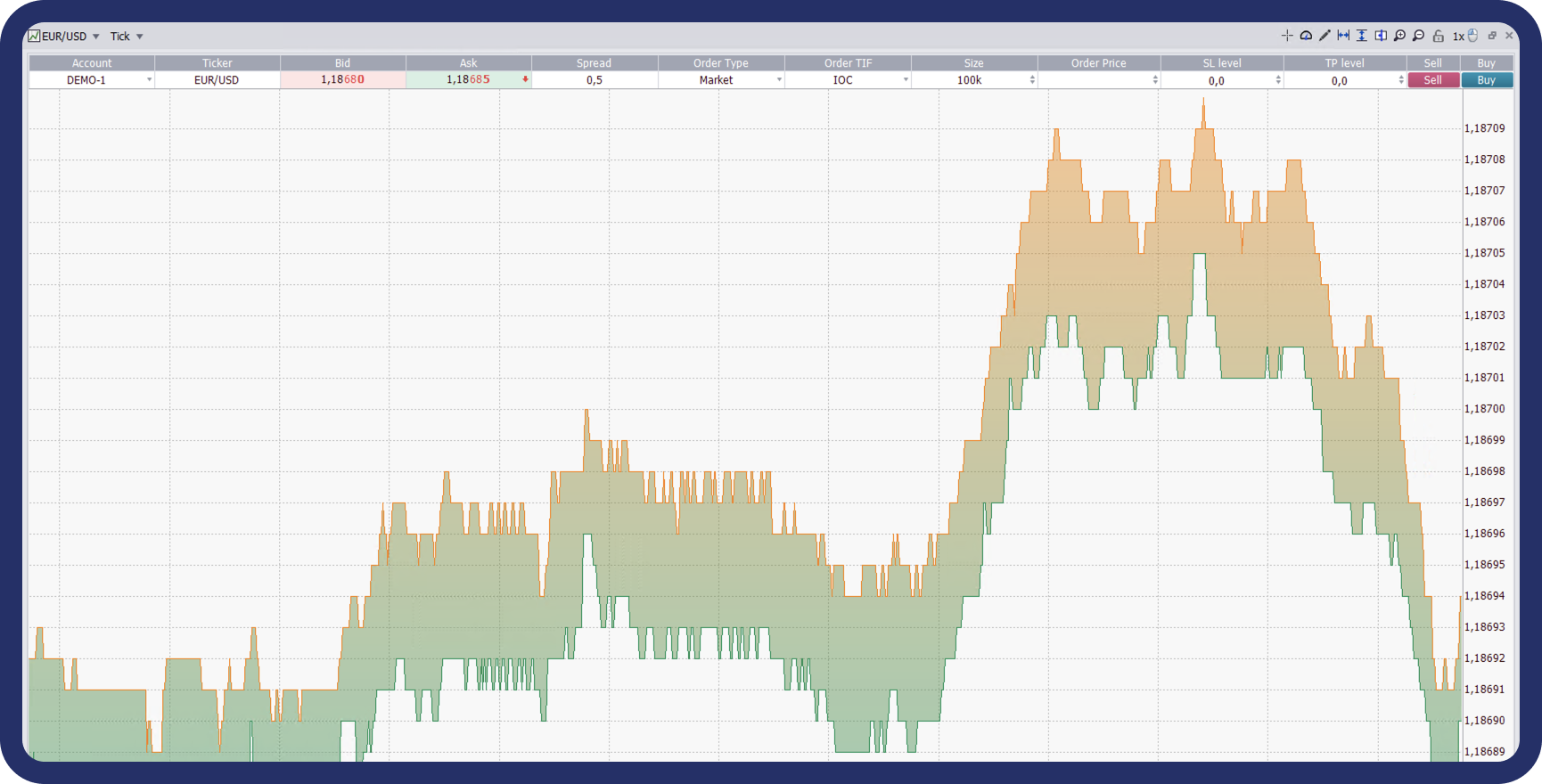

Managing Risks and Client Orders Online

You can use the back-office to track such metrics as profit, loss, position volume, or margin. All client orders can be conveniently arranged in one window and filtered by detailed parameters (for example, the difference between the order itself and the market price). Thus, you will significantly increase the level of risk management, making your brokerage business even more efficient.

Our developers have made sure that brokers can also create and integrate their risk management plugins.

Granting Access Rights and Configuring the Hierarchical Structure of Users

You can combine traders’ accounts into appropriate groups, considering various parameters. Choose the settings for each group and the volume of the displayed data. The number of groups can be unlimited.

If necessary, you can choose individual settings for a particular group, including the size of commission payments, markups, swaps, margin, as well as a unique set of trading instruments. Custom settings can be inherited not only from the parent group. You can also choose the appropriate settings for each specific user.

If necessary, you can choose individual settings for a particular group, including the size of commission payments, markups, swaps, margin, as well as a unique set of trading instruments. Custom settings can be inherited not only from the parent group. You can also choose the appropriate settings for each specific user.

Using the unique functionality of the back-office, you can make changes to the access rights settings based on the rules. The Fin++ back-office administrator can assign different access rights to each department or specific employee.

Here is an excellent example:

«Manager A» can get full access to the management of «Group A accounts» and limited access in the form of viewing profiles in «Group B accounts at the same time.» Meanwhile, «manager B» can view and manage both «A and B groups.» In any case, you will be able to independently choose which access rights have to be granted to the company’s employees for your business to operate correctly.

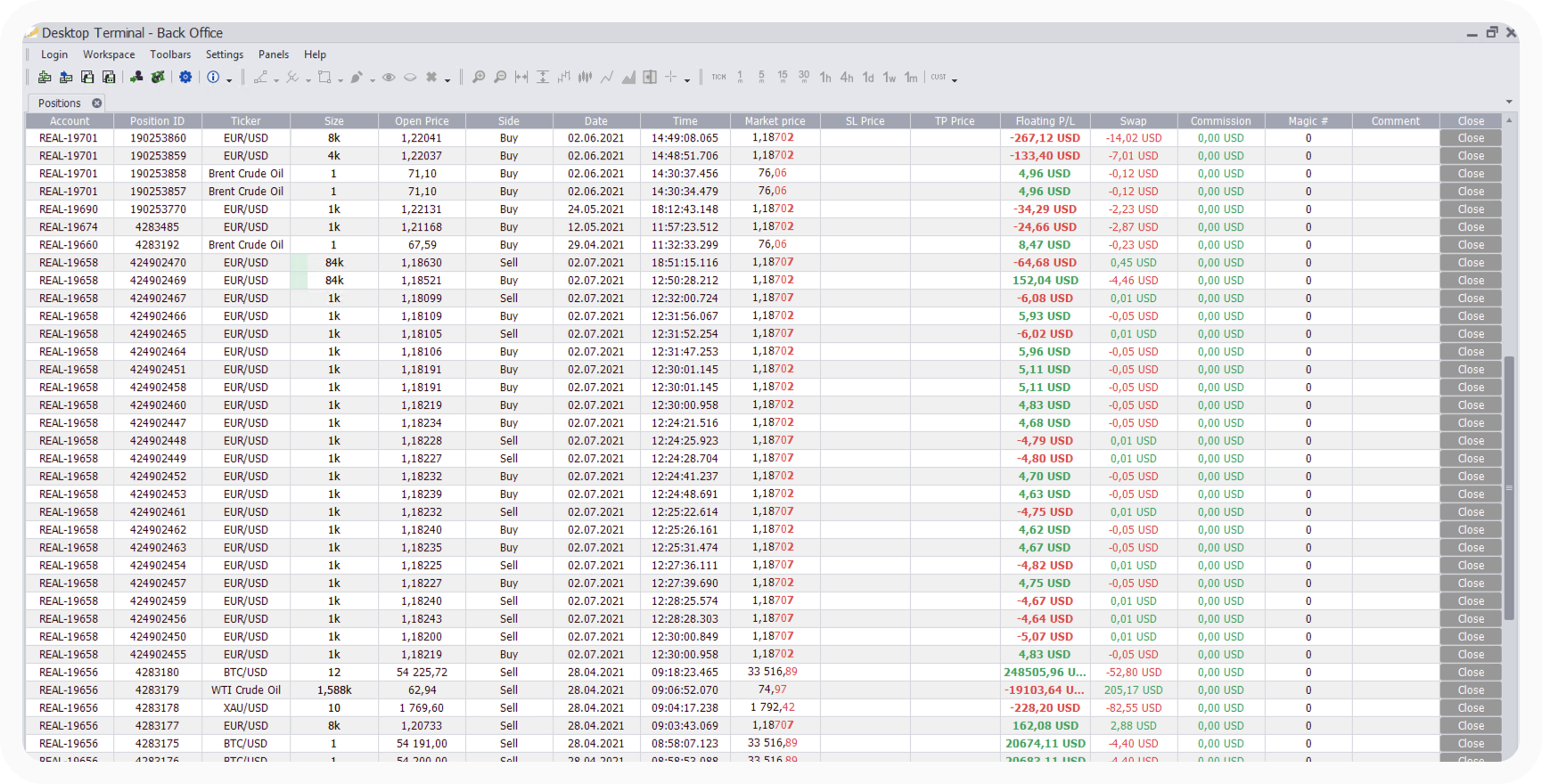

Managing Trading Positions and Orders

Open or close any number of client positions or orders on behalf of the client in real-time.

User Account Management

Using the Fin++ back-office, you can create accounts and collect all the necessary information about traders directly from the platform. The administrator can also make changes to all customer accounts. The back-office functionality also allows you to get instant access to the history of all financial transactions, including:

- Making a deposit

- Withdrawal of funds

- Opening or closing a position

All this data will help you effectively analyze the client’s profile and improve efficiency in risk management.

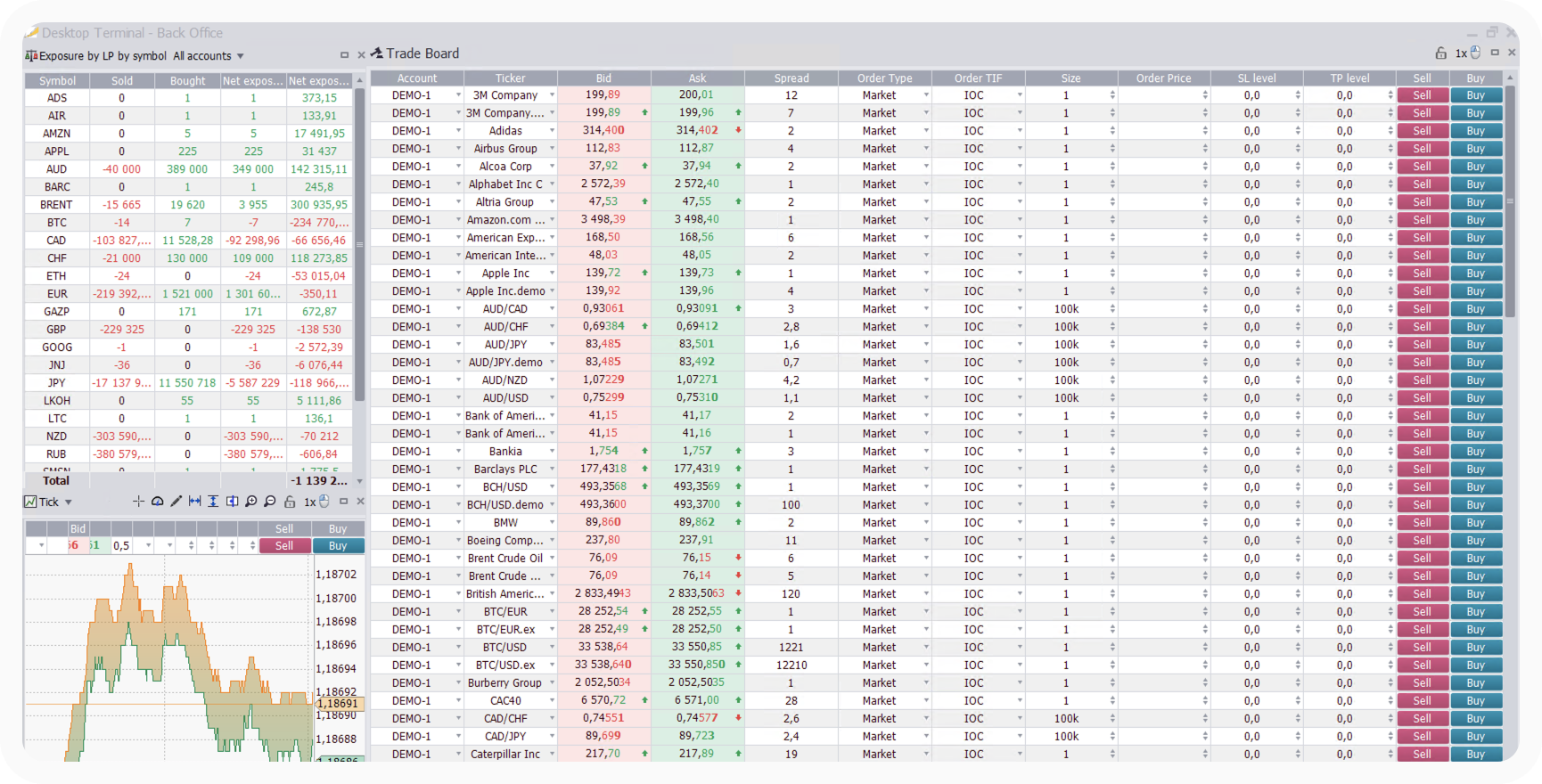

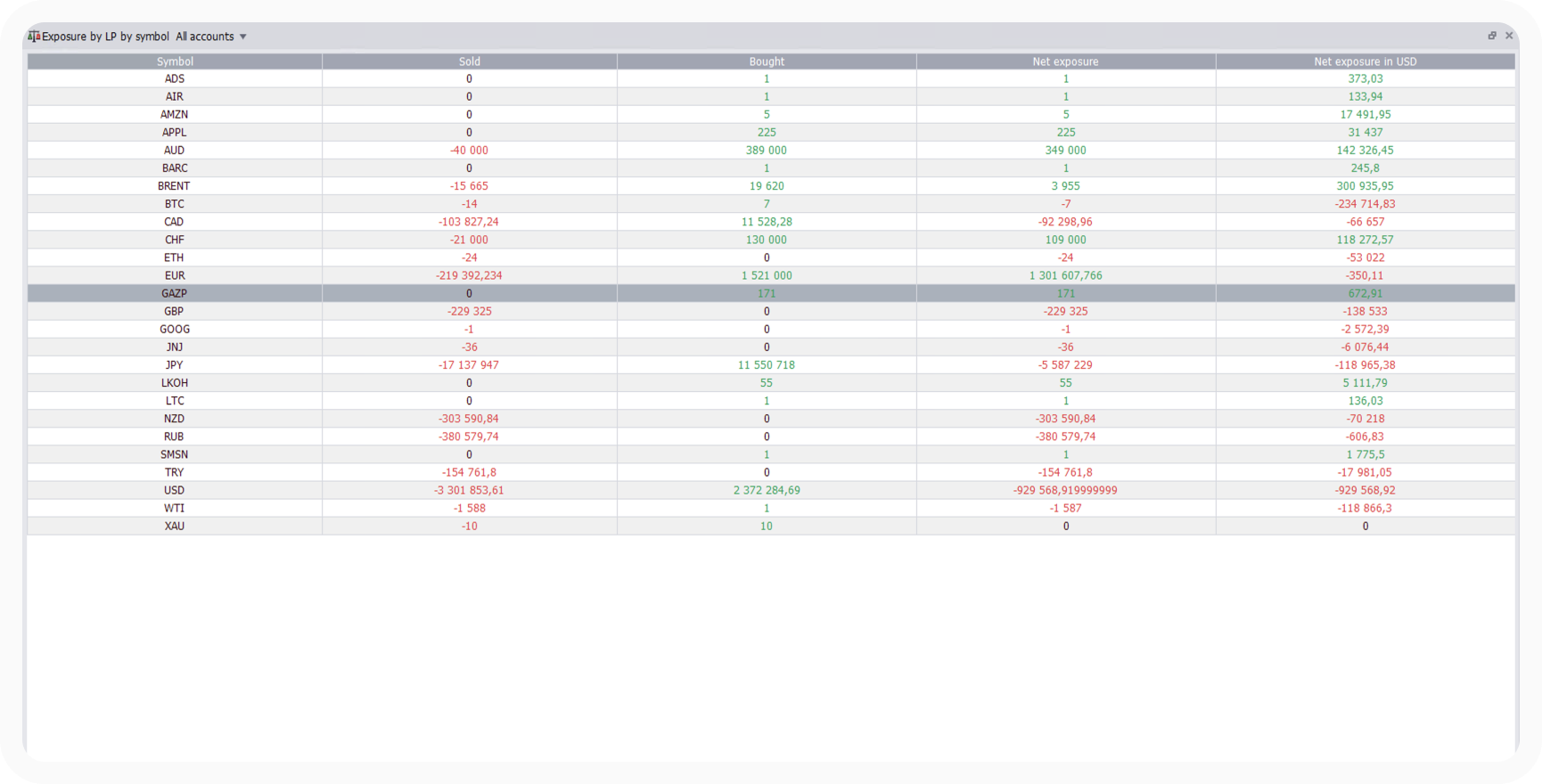

Managing Liquidity Providers and Quote Flows

Fin++ back-office enables you to manage all liquidity providers and control price flows. You can forward orders to external liquidity providers or execute them locally. The Fin++ back-office functionality also allows a broker to modify the routing rules for each client online.

Назад

Далее