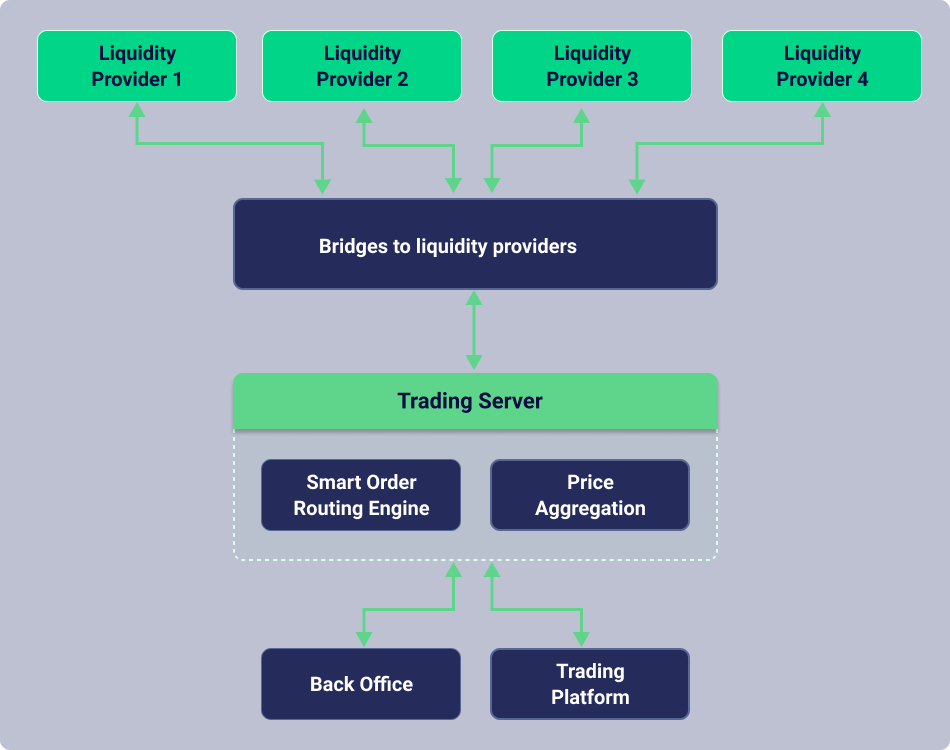

Aggregate quotes from multiple liquidity providers and combining them into a single price stream. As a result, traders receive the most favorable price offer presented in the order “Book.” Moreover, it significantly reduces the risk of low liquidity in times of market volatility.

Cost Reduction

Effective use of the back-office, liquidity aggregator, and trading platforms can significantly reduce the broker’s costs for using services from third-party aggregators.

The benefits of using the Fin++ aggregator are:

- No need to spend additional funds on the purchase of equipment

- The opportunity to integrate with the clearing account and provide independent clearing

- The option to use tighter spreads and increasing profits from lucrative price offers

- The ability to provide a more favorable market price for clients due to low latency in order execution

Efficient Order Routing System

The order can be divided into parts to be processed by separate counterparts, considering such parameters as price, time, and other attributes of quotes.

On the other hand, a market order can be entirely directed to a specific liquidity provider. The order authorization algorithm will automatically select it, considering the most advantageous offer.

The basic version of the liquidity aggregator offers the following set of order types:

- Market, Limit, Stop, and OCO

- GTC, IOC, and FOK

A broker can additionally expand the number of order types at its discretion.